The selloff in Indian IT wasn’t triggered by earnings, guidance cuts, or a sudden macro shock. It was sparked by something more abstract and arguably more unsettling for investors: a credible signal that AI is starting to compress white-collar work at scale.

Anthropic’s latest Claude update, particularly its “Cowork” capabilities aimed at legal and enterprise workflows, became that signal.

Here’s how it played out, and why markets reacted the way they did.

What happened in the market (quick snapshot)?

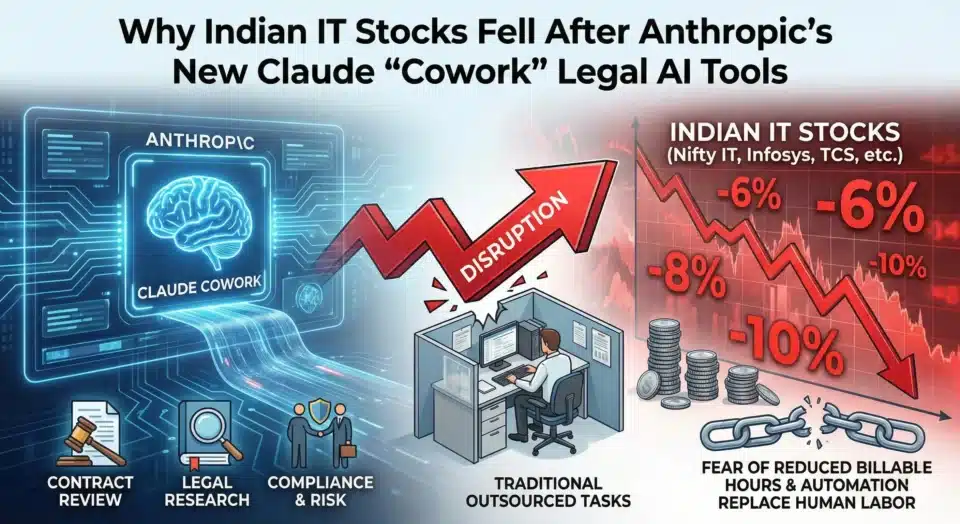

Indian IT stocks saw a sharp, synchronized fall in a single session.

The Nifty IT index slid over 7% intraday before trimming losses. Large-cap names: Infosys, TCS, HCLTech, Tech Mahindra, Wipro, and LTI Mindtree – all dropped meaningfully, dragging the entire sector down.

According to Moneycontrol, roughly ₹2 lakh crore in market capitalization was wiped off across top IT services firms at the day’s worst point.

This wasn’t stock-specific. It was thematic.

What did Anthropic announce, in plain English?

The “legal AI tool” and what it claims to automate

Anthropic announced new Claude “Cowork” capabilities, positioning Claude as a tool that can actively participate in professional workflows, starting with legal work.

As reported by NDTV, the legal-focused features are designed to handle:

- Contract and clause checks

- NDA reviews

- Legal summaries

- Standard drafting and documentation

Anthropic has been careful with its framing. The company emphasizes that Claude does not provide legal advice and requires human lawyer review before use.

But for markets, that disclaimer wasn’t the headline.

The headline was this: routine, billable legal work can now be meaningfully automated.

Why “Cowork” matters beyond legal?

This is where sentiment really turned.

Moneycontrol pointed out that Claude Cowork isn’t just a legal assistant. The same plug-in and workflow logic can extend into:

- Sales operations

- Marketing content and analysis

- Data interpretation

- Internal documentation and reporting

In other words, legal was just the entry point.

Investors quickly extrapolated: if Claude can sit “inside” enterprise workflows, the radius of disruption goes far beyond law firms.

And straight into the heart of global IT services.

Other Recent News:

Google’s Big AI Upgrade for Chrome: Gemini Takes Over Browsing

OpenAI Prism: AI Workspace for Medical & Scientific Research

The Grok AI Undressing Scandal: How One Chatbot Sparked Global Safety Laws

Why investors treated this as a threat to IT services?

The core fear: time compression and fewer billable hours

At the center of the selloff was a familiar but newly sharpened fear: time compression.

Analysts quoted by Moneycontrol argued that AI-driven systems could shrink large enterprise projects, from SAP migrations to digital transformations, from multi-year engagements to a matter of weeks or months.

That matters because traditional IT services economics are built on:

- Large teams

- Long timelines

- Effort-based billing

If Claude-like systems reduce the time and manpower required, then even if projects continue, the billable surface area shrinks.

Another concern followed naturally:

As enterprises integrate AI directly into core workflows, reliance on massive vendor teams could decline, pressuring margins, not just revenues.

The talent pyramid problem

There’s a second-order issue that investors are increasingly uncomfortable with.

Moneycontrol highlighted the risk to the entry-level talent pyramid, the base that supports large Indian IT firms.

Routine tasks such as:

- Testing

- Documentation

- Basic development

- Maintenance work

are exactly the areas where AI is improving fastest.

If those layers thin out, the traditional staffing model—hire in bulk, train, and scale—starts to wobble.

For markets, this isn’t a 2025 earnings issue. It’s a structural model question.

Why this also hit global software and “legal tech” names?

The reaction wasn’t limited to India.

NDTV reported selloffs across European legal and publishing firms, including RELX and Wolters Kluwer, alongside sharp declines in US legal research and software companies.

Losses also spread into the broader software sector.

That’s important: markets weren’t pricing this as “Indian IT faces a problem.”

They were pricing it as “knowledge-work software economics are shifting.”

Indian IT just happens to sit squarely in that blast zone.

Counterpoint: disruption isn’t the same as destruction

“Knee-jerk” vs structural change

Not everyone sees this move as fully rational.

Moneycontrol included views suggesting the selloff looked sentiment-driven, with markets possibly overestimating near-term financial impact while underestimating how slowly large enterprises actually change core delivery models.

There’s also a familiar market pattern at work:

inflection moments get priced in before numbers show up.

This may be less about immediate revenue loss and more about the market forcing a conversation around old assumptions.

Where spend could shift instead of disappearing

Crucially, Moneycontrol also made a more nuanced point: enterprise spend may not vanish, it may move.

Potential shifts include:

- From effort-based billing → outcome-based pricing

- From custom build → platform-led delivery

- From headcount scaling → AI-augmented execution

Firms that adapt quickly, using AI to improve margins rather than fight automation, could actually emerge stronger.

History suggests incumbents don’t always lose. But they do have to change.

What to watch next?

- Do Indian IT firms begin explicitly shifting new deals to outcome-based pricing models?

- Do management teams guide toward lower entry-level hiring due to automation in testing and routine development?

- Do clients accelerate AI-led platform adoption specifically to cut transformation cycle times?

The answers will matter more than any single AI announcement.

Conclusion

The fall in Indian IT stocks after Anthropic’s Claude Cowork announcement wasn’t about one product or even legal AI specifically.

It was about credibility.

For the first time, markets saw a widely adopted AI platform making a plausible case that large chunks of professional, billable work can be compressed, automated, or re-priced.

That challenges the core assumptions behind global IT services.

Whether this turns into long-term damage or a forced evolution will depend on how fast and how honestly incumbents adapt.

FAQs

Because investors fear AI tools like Claude Cowork could reduce billable hours, compress project timelines, and weaken traditional effort-based IT services models.

No. Anthropic explicitly states the tool does not provide legal advice and requires human review. The concern is automation of routine work, not full replacement.

Markets interpreted the announcement as category-level disruption to knowledge-work software and services, not a company-specific event.

Unlikely in the near term. Most analysts see this as a medium-to-long-term structural risk, not an immediate earnings hit.

Yes, if they shift toward outcome-based pricing, AI-led platforms, and higher-value advisory work rather than pure manpower-driven delivery.

The erosion of the entry-level talent pyramid and margin pressure from faster, AI-compressed delivery cycles.

Related Blogs:

GPT-5.1 vs Claude Opus 4.1: Which AI Model Performs Better

Claude AI Introduces Real-Time Web Search

Can Claude Fill Out Applications for You Directly on a Website

How to Use Echo Writing in Claude